Renowned risk specialist, Russell Collins, provides his own perspective on Australia’s underinsurance dilemma. Responding to Riskinfo publisher, Peter Sobels, in relation to a poll addressing underinsurance, Russell takes a step back to reflect on the nature of an unresolved issue that has been present in our community for decades prior to the implementation of recent regulatory mandates such as the LIF and FASEA reforms.

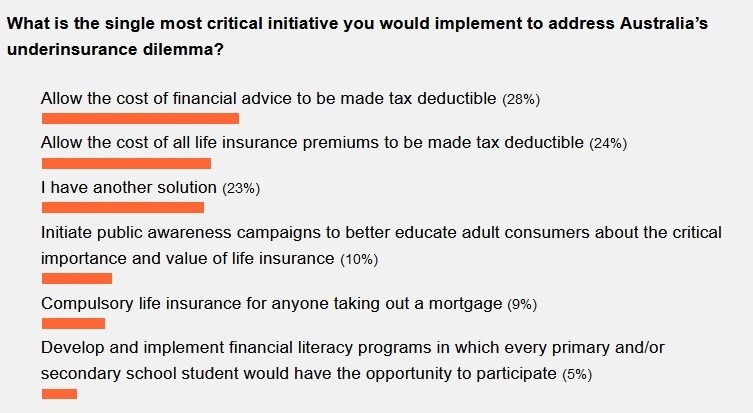

Peter, in our recent correspondence you mentioned to me about this underinsurance problem survey. Looking at the options I would have voted for “I have another solution”*. Each of the current options is really “external” to the advisory area. I think the problem rests within the advisory area, that is, why isn’t more life insurance being sold?

…many advisers see [life insurance] as a product to be sold rather than an opportunity to build long-term relationships with clients…

With my 40+ years of association with the industry as an adviser and mentor, I really believe that one of the major reasons for this problem relates to the current advisers’ lack of belief in both the product and the benefit that life insurance plays in people’s lives. Life insurance is the only product that can change expectations into certainties and promises into guarantees! In other words, many advisers see it as a product to be sold rather than an opportunity to build long-term relationships with clients who care about protecting families and/or business, in the event of their dying too soon.

People buy what they understand…

Underlining this lack of passion is the training programs for newer, and not so new, advisers in the industry. There is a major emphasis on product knowledge and technical skills and an under-emphasis on communication skills. Advisers are more educators than they are salespeople, and their education starts with their own self-education in communication skills. People buy what they understand, and they don’t buy what they don’t understand!

Over the years I have observed two major reasons for many financial advisers not being involved in the risk insurance area. First, they’re still stuck in a time tunnel where ‘selling’ (life insurance) is very unprofessional, i.e. if you sell for a living you wouldn’t be regarded as professional, but if you want to be regarded as professional, then you wouldn’t sell for a living! In other words, ‘selling’ and ‘professionalism’ are mutually exclusive. Yet these very same advisers spend every minute of their day ‘selling’ their advice to prospects and clients!

Second, and probably more valid, is that it takes too long to get a case completed and, if it’s declined during underwriting, then their time has been wasted (unless they have charged some form of preparation fee). But, again, the latter advisers have not been taught how to process their cases through underwriting so that they have the opportunity to educate the underwriters and discuss proposed adverse decisions with them before the final decision is made. And if the final decision made is one that includes a premium loading, they don’t know how to sell the loading to the prospect/client with success. Again, this is all related to communication skills.

People don’t buy life insurance because they’re going to die, they buy life insurance in order that others might live…

Selling life insurance is not a job – it’s a vocation! Advisers who specialise in this area get the opportunity to leave home every single day, knowing that they can make a difference in the financial lives of the people with whom they come in contact that day. Every time I delivered a death claim or disability claim cheque, I knew that I made a financial difference in the lives of the people or businesses that were the recipients of those cheques. This added meaning and value to my life and provided dignity, financial stability and independence to the recipients of those cheques. Left to themselves these people would not have instigated the process of purchasing these policies. I approached them. I took the initiative to convince them of the need to meet with me to hear how I could help them.

People don’t buy life insurance because they’re going to die, they buy life insurance in order that others might live. Therefore, it’s a character purchase! These people are going to pay premiums for years knowing that they will never witness the legacy they have provided.

As long as love and a sense of obligation continue to exist in abundance in our society, there will always be a need for life insurance and life insurance advisers.

___

This article, including the feature image, was first published by AdviserFocus.