With business owners, when discussing the area of estate planning, I asked two specific questions: “Will your heirs inherit a gross estate or a net estate?” AND “If you had died yesterday, what amount of shrinkage would your estate have suffered?”

Whatever their answers, I recorded them at the time and then later in the meeting I would mention “the reason I asked those questions is that from my experience successful business owners never seem to die at the beginning of something; they never seem to die at the end of something; rather they all seem to die smack bang in the middle of something!” I then added: “tell me, do you know any successful business owner who died at the perfect moment?” Everybody answered in the negative, but it’s amazing how many people would be aware of another business owner who did, in fact, die at the wrong time!

I then said to them — “as a consequence of not dying at the right time, most busy business owner’s estates look like this.”

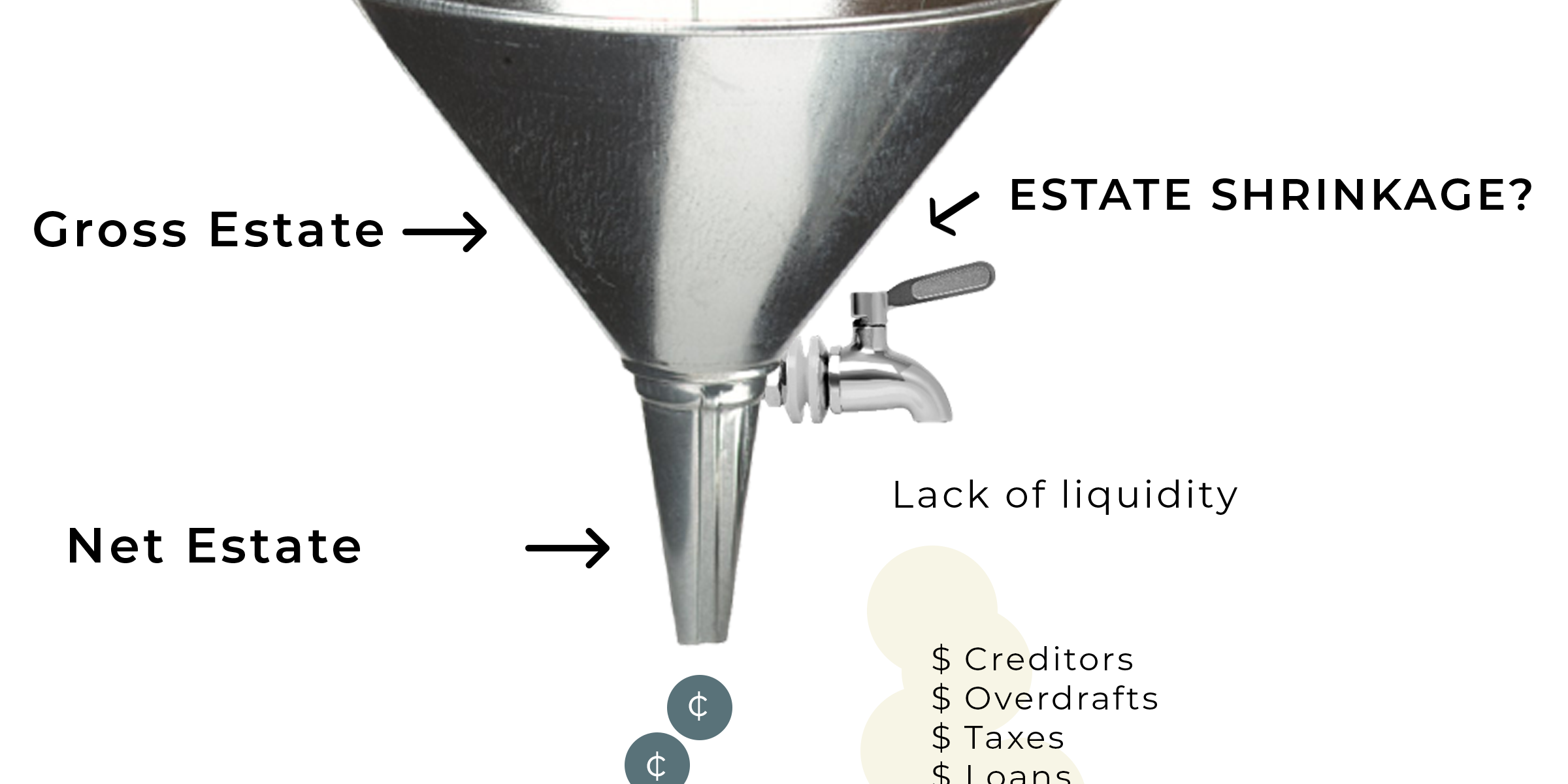

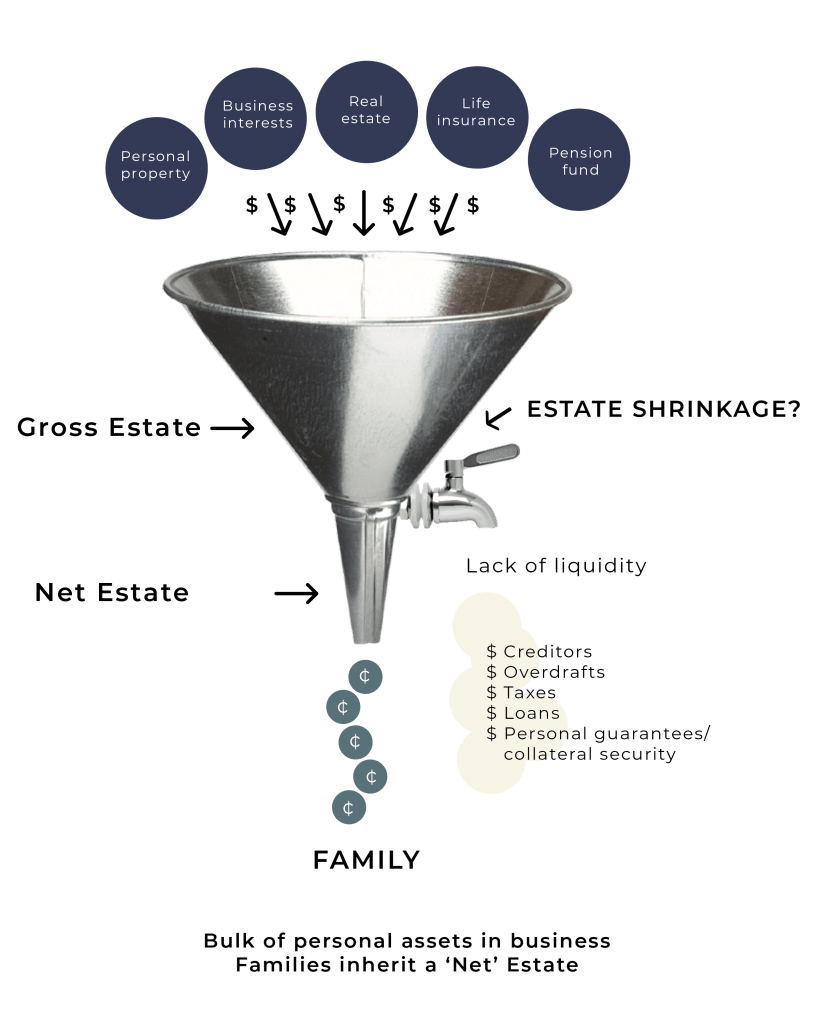

I then proceeded to draw this funnel in front of them and commented:

“All assets — personal & business – go into the top of the funnel, the purpose being that the family will be the major beneficiary (bottom of the funnel). These assets going into the top of the funnel represent ‘a lifetime of effort’ to the deceased. In most cases, because of little or no estate planning up to that point in time, the deceased has both a gross estate and a net estate. The net estate enters the equation because all funnels have siphons — thus assets are siphoned off by the creditors before they reach the family because of standing arrangements (personal guarantees/assignment of collateral security) between the deceased and his/her creditors”.

At this point, I referred to the gross estate i.e. pointed to the assets going into the top of the funnel and I drew ‘$’ signs around the entrance to the funnel. Then, pointing to the bottom of the funnel, I drew ‘cent’ signs near the word “family” to again emphasise poor planning i.e. on death, dollars flow into the top but, sadly, only cents flow out the bottom of the funnel to the family. I then drew an arrow just above the siphon to highlight the actual “estate shrinkage” of a gross minus net result, based on an earlier discussion of assets/liabilities.

I then finished up on this concept with the following comments: “Mr/ Mrs prospect I find that with many small business owners the bulk of their personal assets are tied up in their businesses. And, if there has been little or no estate planning, this, in turn, can have a crushing effect on the family members since they inherit a net estate. A lifetime of effort wasted.

If we can establish a working relationship, I can show you how I have been able to guarantee my clients that when they die, their gross estate and their net estate will always be one and the same! In your case, therefore, “a lifetime of effort” will never be wasted.”

In summary, this concept demonstrates that business owners have a gross estate and a net estate. The adviser’s role is to ensure that at the business owner’s death, by providing the life insurance to pay out creditors, their gross estate and net estate will always be one and the same!