Russell Collins’ book is a game-changer for any adviser regardless of their time in the business. It will help you be referred to larger cases that are more easily placed and have better persistence.

“Russell, if you had died yesterday, everything you have in your brain would have died with you. As a consequence, you would have missed a golden opportunity to have left your legacy to our industry!”

These words came from Daryl LaBrooy, a Financial Adviser based in Melbourne, and his “if you had died yesterday” comment was actually repeating back to me what I usually tell my audience when I talk to them about how to create a sense of urgency amongst their prospects and clients. I had joined Daryl for lunch in Sydney in late 2010 where his kind words unwittingly caused me to seriously think about my legacy to the industry.

For years people had been asking me when were they going to see my book? Or had I planned on writing one? My answer was always the same – I had no time! Until Daryl happened.

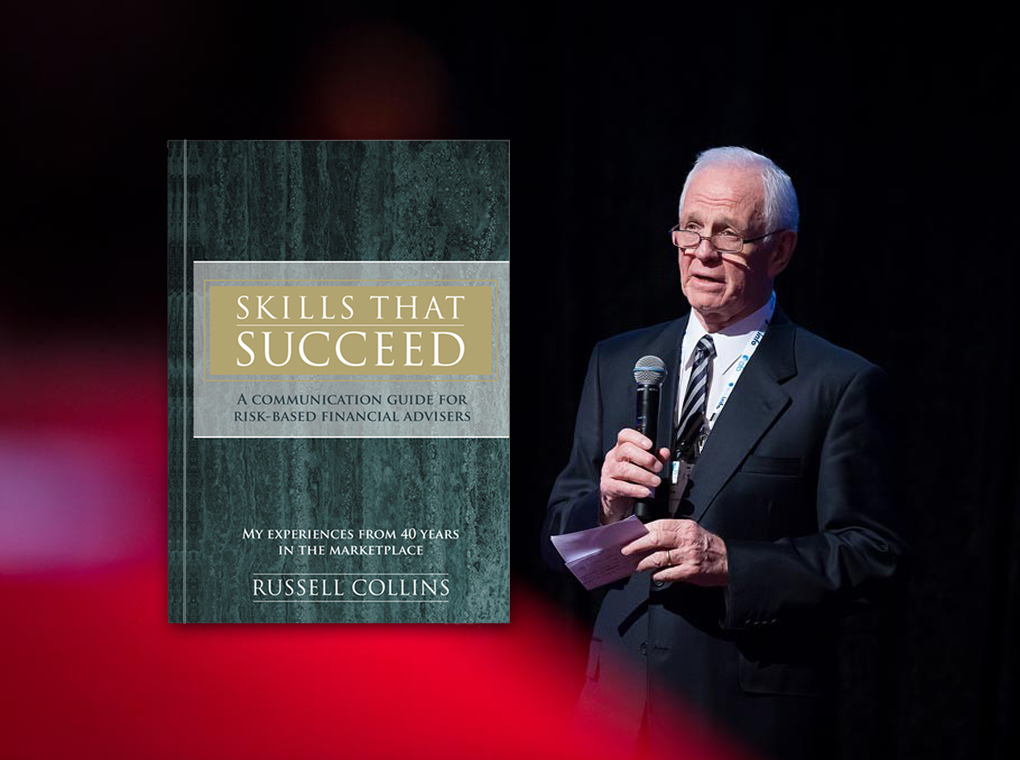

I didn’t start on the book immediately after that luncheon, but the thought was regularly on my mind. Finally that December I started to look back on important milestones of my career: the national and international professional advisers who had influenced and mentored me; the things that I had learned and was able to pass on to others for their benefit; the hard business decisions that had enabled me to build a clientele from scratch – all of which had added meaning and value to my life. This helped to start the fire. Skills That Succeed is the result.

This book represents my professional odyssey and chronicles the knowledge that I acquired during my four decades as a Financial Adviser. It addresses the importance of developing communication skills which people will both understand and act upon. These skills enabled me to achieve a level of success which far exceeded my initial expectations, as well as the personal satisfaction of knowing that when I left home for work each day I had the opportunity to make a difference in people’s lives. Hopefully, my book will provide you with the opportunity to discover your own untapped potential.

Russell Collins, 2020